Jul . 31, 2024 07:17 Back to list

Exploring the Future of Sustainable Energy Solutions for a Greener Planet and Economic Growth

Understanding Post-Cap A New Paradigm in Market Regulation

In the dynamic landscape of financial markets, regulatory frameworks continually evolve to accommodate the changing needs of participants and ensure fair practices. One such emerging concept is the Post-Cap, a term reflecting a set of regulations aimed at mitigating excessive speculation and ensuring market stability. This article delves into the significance of Post-Cap, exploring its implications for investors, market participants, and the broader economy.

What is Post-Cap?

The term Post-Cap refers to regulations that come into effect after a specific cap or limit has been reached in trading activities, whether in derivatives, commodities, or other financial instruments. Unlike traditional cap regulations that impose restrictions before certain thresholds are reached, Post-Cap measures activate once predetermined criteria are met. This approach allows for more flexibility and responsiveness to market conditions, addressing concerns about volatility and speculation without stifling liquidity in the marketplace.

The Rationale Behind Post-Cap Regulations

The financial markets have witnessed periods of extreme volatility, often exacerbated by speculative trading practices. Such behavior can lead to price distortions, making it difficult for companies and investors to operate efficiently. By implementing Post-Cap regulations, regulatory bodies aim to prevent such scenarios by introducing controls that trigger responses only when trading activity becomes undeniably excessive.

For example, during a market rally, investors may engage in a frenzied buying spree, driving prices to unsustainable levels. If the trading volume surges past a certain threshold, Post-Cap measures may enable authorities to implement trading halts, margin requirements, or increased reporting obligations. These interventions can help to stabilize prices and restore confidence among market participants.

Implications for Investors and Market Participants

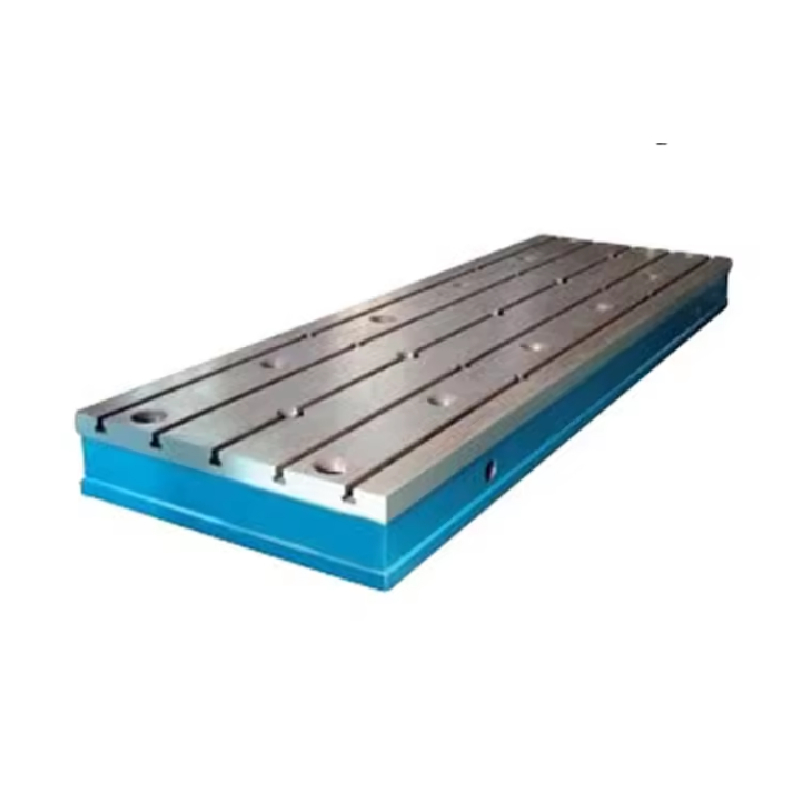

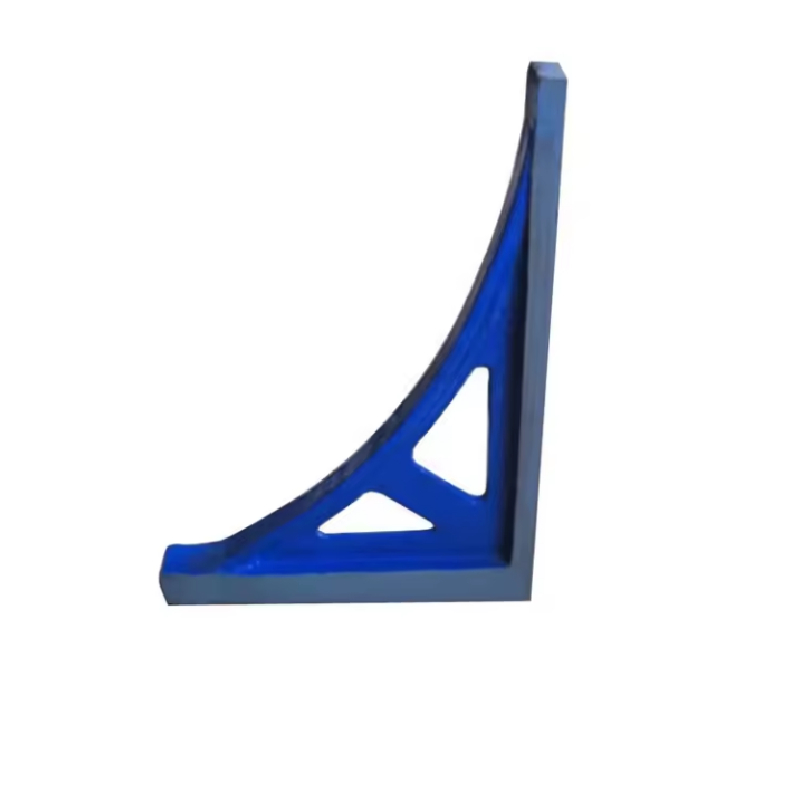

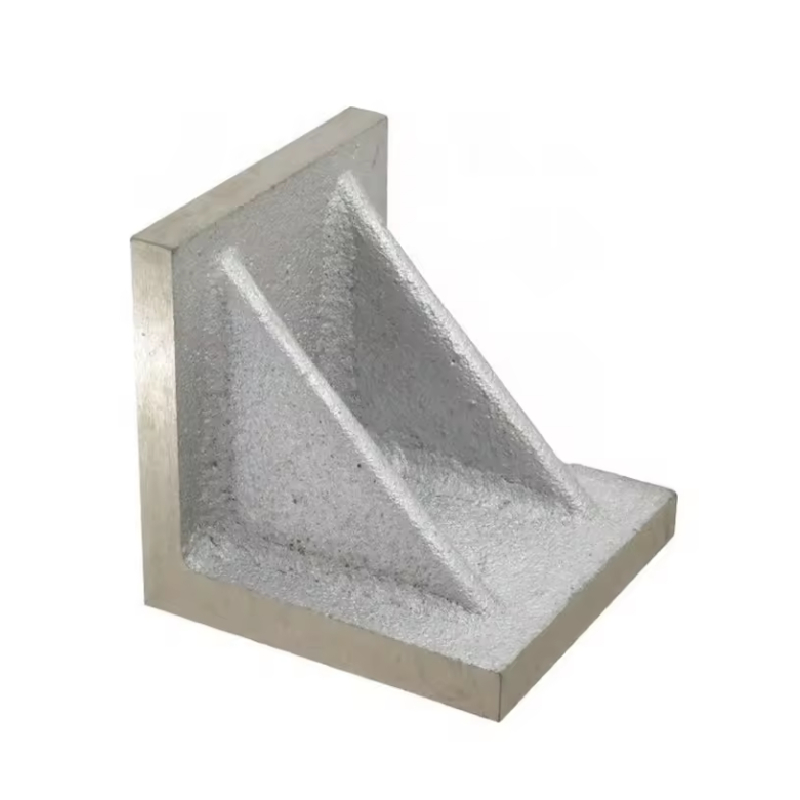

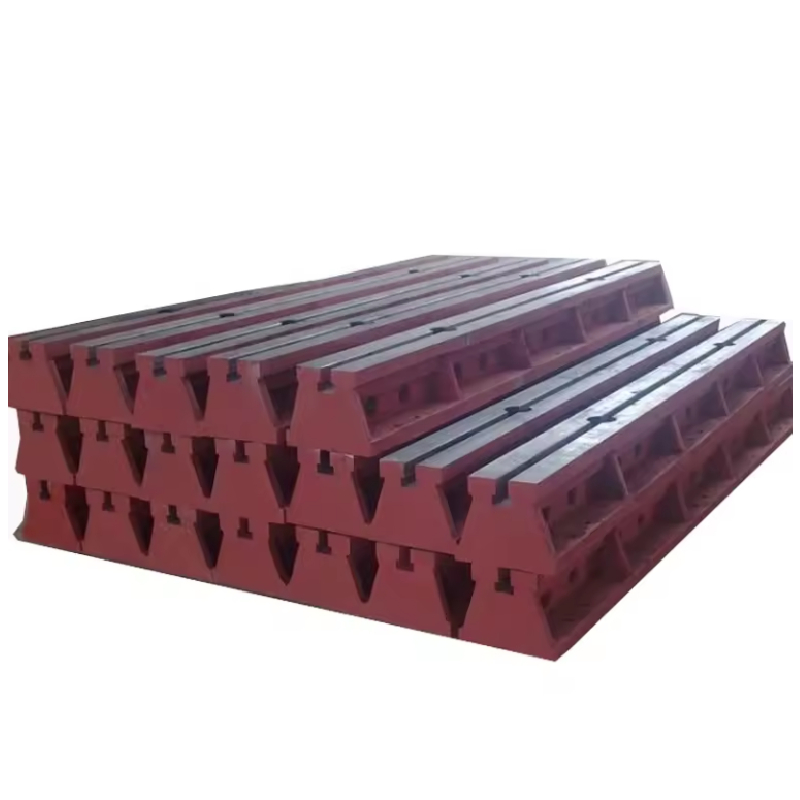

post cap

For investors, the introduction of Post-Cap measures can create both challenges and opportunities. On one hand, these regulations may impose constraints on trading strategies, particularly for high-frequency traders and those who thrive on market volatility. The additional requirements may lead to increased transaction costs and necessitate adjustments in trading algorithms.

On the other hand, the establishment of a more stable trading environment can enhance investor confidence. By reducing the risks associated with extreme price fluctuations, Post-Cap regulations can attract a broader range of investors, fostering a more diverse and resilient marketplace. This stability is particularly beneficial for long-term investors, who often seek certainty and predictability in their investment horizons.

The Broader Economic Impact

At a macroeconomic level, the implementation of Post-Cap regulations can contribute to greater market integrity and reduce systemic risks. By curbing excessive speculative trading, these measures can help prevent the formation of asset bubbles, which can lead to severe economic downturns when burst. A more regulated and stable financial environment supports sustainable economic growth, allowing businesses to make informed decisions and invest in innovation without the overhang of market instability.

Moreover, Post-Cap regulations can enhance the reputation of financial markets, promoting transparency and accountability. This can lead to increased foreign investment, which is crucial for economic development in many countries. Investors around the globe seek markets that prioritize integrity, and effective regulation can serve as a key differentiator.

Conclusion

Post-Cap regulations represent a forward-thinking approach to market regulation, balancing the need for liquidity with the necessity of stability. As financial markets continue to evolve, the implementation of such measures will be crucial in addressing the challenges posed by excessive speculation and volatility. By fostering a more resilient trading environment, Post-Cap can ultimately contribute to a healthier economy, benefiting investors and the broader society alike.

-

thread-plug-gauge-our-promise-of-measurement-excellenceNewsAug.22,2025

-

gauge-pin-class-reflecting-quality-legacyNewsAug.22,2025

-

check-valve-types-for-high-rise-buildingsNewsAug.22,2025

-

water-control-valve-for-irrigation-systemsNewsAug.22,2025

-

gate-valve-with-soft-seal-technologyNewsAug.22,2025

-

y-type-strainer-for-oil-and-gas-applicationsNewsAug.22,2025

Related PRODUCTS